WhySave

Ever thought about saving and then moved on without doing anything about it? Here’s where to get started. We’ll talk about not only why you need to save, but also how to identify the right medium. It doesnt matter how much you earn or how old you are. We all need to start saving, today.

Why We Need To Save

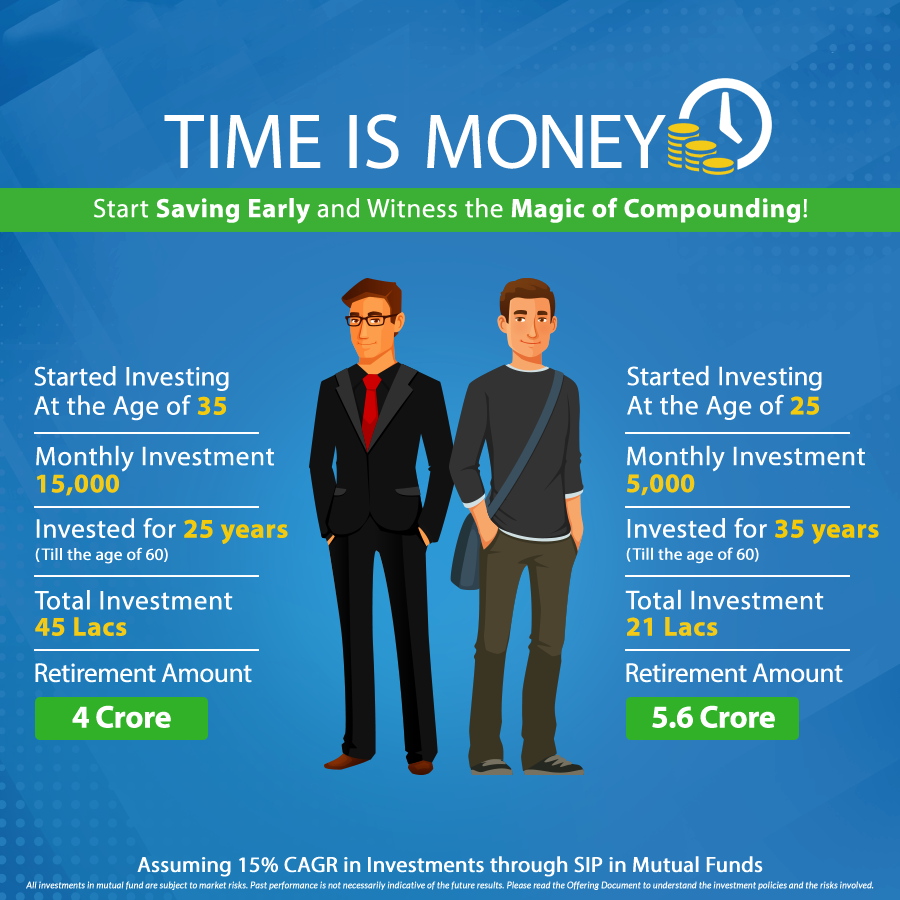

Over the years we have become a nation of spenders rather than savers. With a rise in consumerism, everyone is busy planning where to spend their money instead of planning how to grow their money over time. The habit of savings and then investing that amount (no matter how small) is how you can better meet your future expenses. Whether you wish to buy a new phone in the short run, or take a world tour in a year’s time, regular savings can help you achieve your dreams!

Saving helps you

Put Excess Cash to Use

Meet short term Goals

Plan for long term goals

How to Save?

Saving isn’t as complicated as it seems. Make small adjustments to your budget and then figure out how to manage and increase the money that you’ve saved. That’s the first stage!

Don’t let excess cash in your bank account waste away. Make your money work for you; and there’s no better option than Mutual funds for that!

What are Mutual Funds?

Mutual funds are a great way for millions of people to invest in stocks, bonds, and more, without having to master finance!

Mutual Funds are one of the most common investment types for every day investors. Why? The accessibility, liquidity and easy-to-understand features of Mutual Funds make it a powerful investment vehicle for not only the investment pros but also investors who are just starting off.

Features of Mutual Funds

Simplicity

Accessibility

Diversity

Variety

Affordability

Professional Management

Tax Benefits

Benefits of Mutual Funds

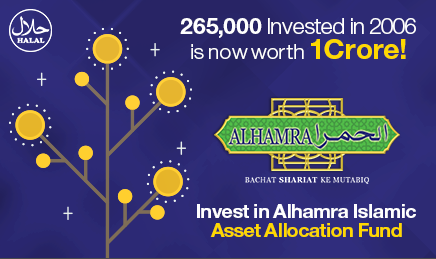

Mutual Funds Success Stories with MCB Funds

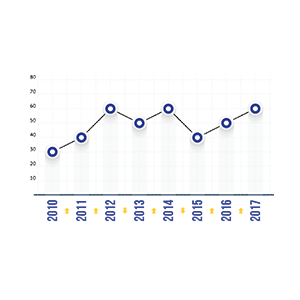

MCB Funds (a subsidiary of MCB Bank Limited) is an Asset Management company that has been providing trusted financial guidance and unparallel returns to its customers since the past 15 years. The company manages over PKR 73 Billion in portfolio across Conventional and Shariah compliant funds, delivering excellence to over 70,000 investors. Read More

Getting Started with Mutual Funds is easier than you think!

Open an iSave Account in Just 3 minutes!

For the 1st time in Pakistan now you can become a Mutual Funds investor Online! iSave is a Digital Savings Platform that allows you to open your Mutual Funds account online without the hassle of paperwork

Manage your investment on the go and Make your money work for you!

Why choose iSave?

Open an online account in just 3 minutes

Get started with your first investment within minutes

Generate your online statement with just a few clicks

Manage your investment anytime, anywhere

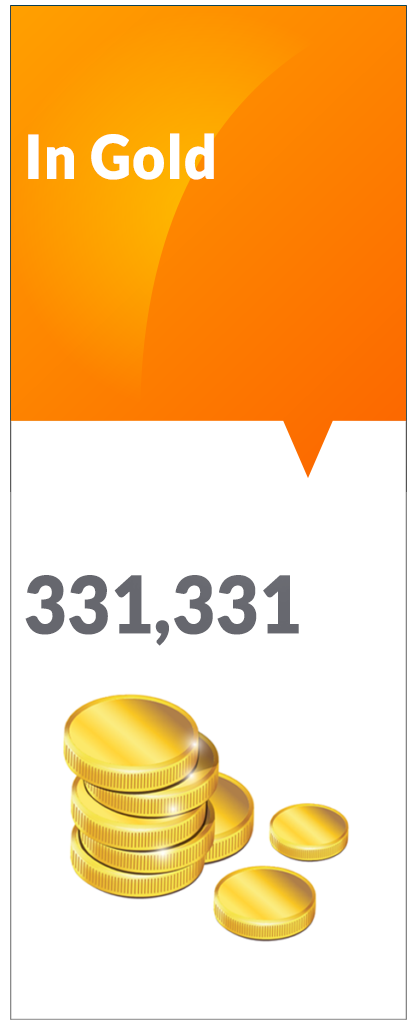

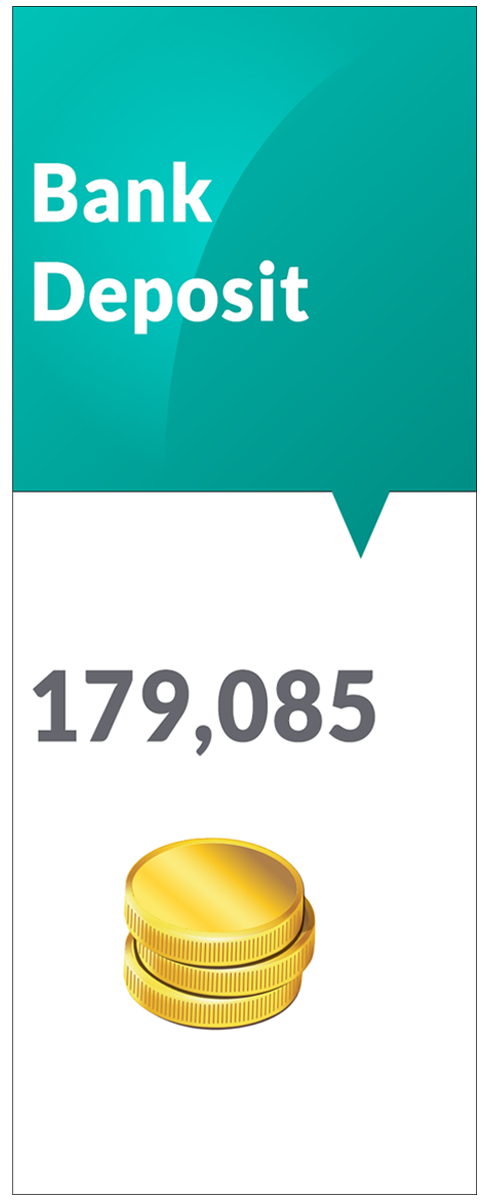

Lower cost higher returns than other saving options

Say goodbye to paperwork and branch visits! Just sit back and relax

More About Mutual Funds