iSave

Here’s a Summary

Account Creation

If you aren’t an MCB Funds customer, you can sign up within 3 minutes using iSave. Simply click the new customer button to sign up. Click the new customer option, provide the required details and your account will be ready as soon as you finish the forms! Please make sure you enter correct details though, as this can affect the ability of your account to function smoothly.

Portfolio View at First Glance:

The first screen after login will show you the total value of

your investments.

Transactions

Once you log on to iSave, you will see 3 buttons that will

take you to the next step. You have a choice of the following 4 transactions:

Investment

Redemption

Conversion

Create SIP

Payment Facilities:

The Invest feature allows you to place an investment request with us, after which you can either simply pay online or pay via cheque.

Online Payment: Log in to your internet banking platform and make the payment. Do remember, you will need your Master Relationship Number to make the transaction. For instructions on how to make the payment for each bank, click here.

Cheque Pickup: To request a cheque pick up, at the time of investment select pay via cheque. You will then be contacted by our team to coordinate a time for pickup. Please follow the instructions for how to write a cheque and mention your Master Relationship number at the back.

Map New Account

Map new account is available from the settings menu. If you have more than one account with MCB Funds but can’t see it in your iSave account, use the “Map New Account” feature and fill in the information for the relevant account. Do note that if you are a joint account holder, you may have limited access based on the principal holder’s discretion.

Change Password

You can change your passwords whenever you wish for security purposes, as long as the new password is as per our policy. Here’s a quick guideline on the kind of passwords that are permitted.

Account Summary

You can see the breakup of their investments on a fund-wise level by selecting the Account Summary option.

Statement of Account

If you would like a detailed Statement of Account, use this option. You will be required to select the fund for which you require the statement and specify duration.

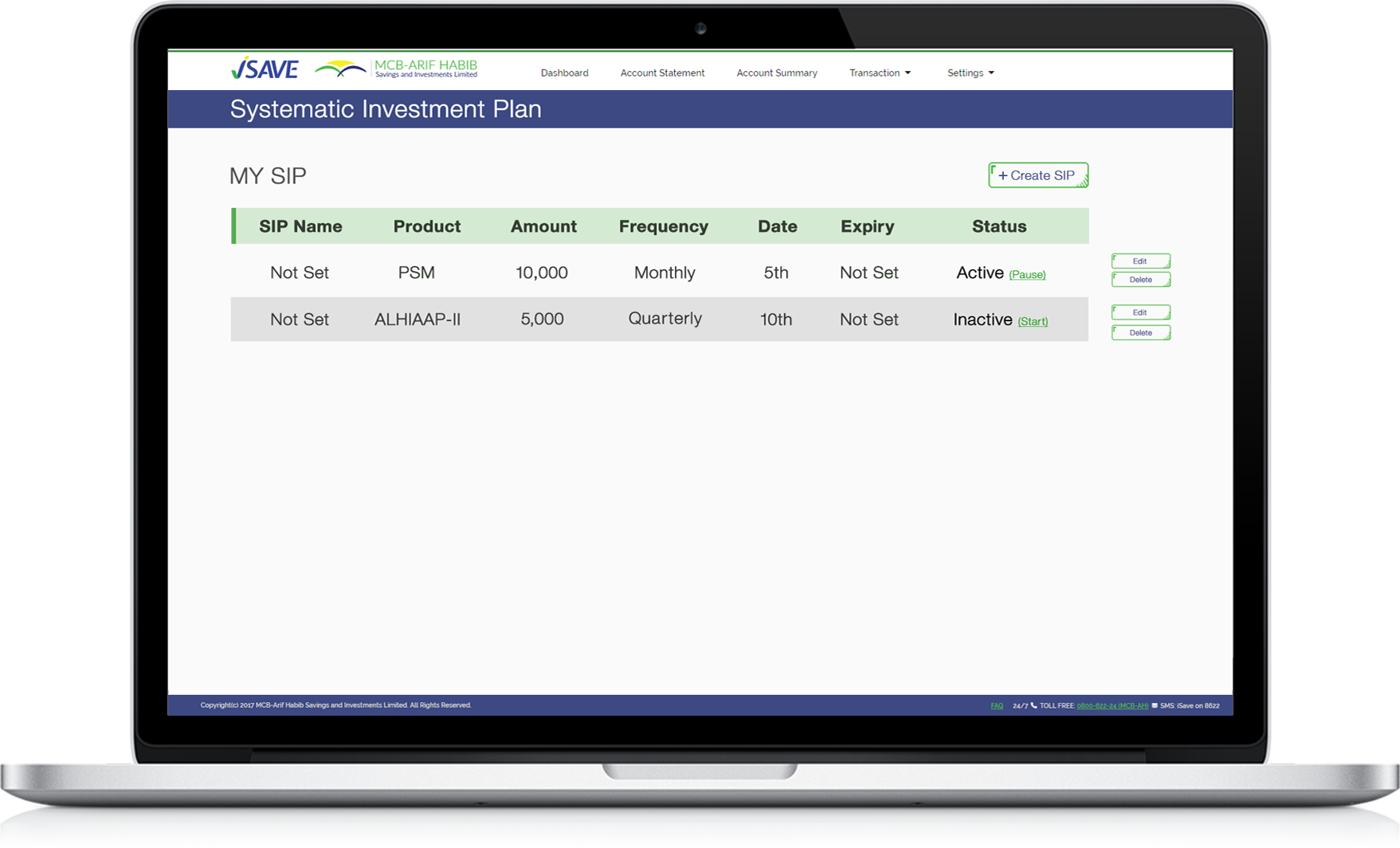

SIP

SIP Stands for Systematic Investment Plan. This feature allows you to create an automated investment request at a pre-specified interval for a fund of your choice. You can give each SIP a name, which basically could be the name for your savings goal. At the defined interval, the SIP system will create an investment form and you will receive an email when the form is placed. You can then make the payment using your MR Number from your bank. To read more about SIP, click here.